Hello and welcome to another insightful article on the Chartered Financial Analyst level 2 examination.

At the end of this article, you will learn about the CFA level 2 exam structure, registration, curriculum, how to pass using prep courses, and more.

This article shall cover the following:

So, relax, and let’s continue!

CFA Level II Exam Structure and Duration

The CFA Level II exam comprises item sets that include vignettes and 88 multiple-choice questions.

The Level II exam will last 4 hours and 24 minutes, divided into two 2-hour and 12 minute periods with a break in between.

Each topic consists of a vignette on the CFA test followed by four or six multiple-choice questions.

Each of the two sessions will have 44 multiple-choice questions, for a total of 88 questions on the exam, each worth three points.

Candidates must use the information in the vignette to answer multiple-choice questions in each item set.

As a result, unlike the CFA Level I exam, the items are not free-standing.

Therefore, before answering each question, you’ll need to refer back to the vignette.

CFA Level II Curriculum

The CFA Program includes foundational knowledge and advanced investment analysis and portfolio management skills, critical in today’s investment management.

An Education Advisory Committee comprised of industry practitioners, security market regulators, university faculty, and policymakers develop the curriculum.

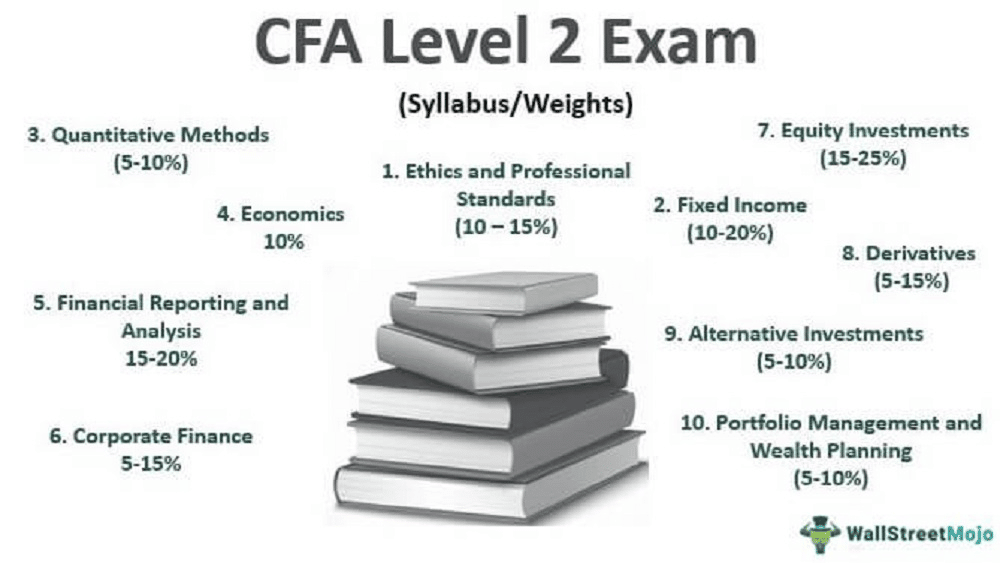

The core curriculum topics of the CFA Level II exams are:

Ethical and Professional Standards: The primary emphasis is on ethics, ethical issues, and the significance of ethics and professionalism in the investment sector.

It establishes a foundation for making ethical decisions.

It examines the code of ethics, professional conduct, and global investment performance standards to provide a framework for ethical decision-making.

Quantitative Methods: This section delves into the quantitative principles and methods utilized in financial analysis and investment decision-making.

It introduces return distributions and gives descriptive statistics for expressing crucial data qualities such as central tendency, location, and dispersion.

The section also looks at probability theory and its uses to quantify risk in investment decisions.

Economics: This section delves into the fundamental notions of supply and demand for individuals and businesses.

It also looks at macroeconomic concepts and principles such as aggregate output and income measurement, aggregate demand and supply analysis, the reasons for economic growth, and the various market systems in which businesses operate.

The impacts of the business cycle on economic activity are discussed at the end of the section.

Financial Statement Analysis: Also referred to as Financial Reporting and Analysis, this topic covers financial reporting techniques and the standards that govern financial reporting disclosures, focusing on fundamental financial statements and how different accounting methods affect those statements and their interpretation.

It looks at primary financial statements and lays a fundamental framework for financial statement analysis.

Corporate Finance: This chapter introduces corporate governance and investment and finance considerations.

It gives a framework for understanding and analyzing corporate governance and stakeholder management and an overview of corporate governance.

It also emphasizes the growing importance of environmental and social factors in investment decisions.

It also looks at how businesses leverage and manage their working capital to satisfy short-term operating requirements.

Equity Investments: This chapter delves into the characteristics of equity investments, security markets, and indexes, how to analyze industries, firms, and equity securities, and how to utilize fundamental equity valuation techniques.

Longer-term growth and diversification objectives necessitate the use of global stocks.

Fixed Income: This topic covers how to describe fixed income securities and markets, yield metrics, risk variables, and value measurements and drivers in this course.

The value of fixed income securities, asset securitization, the basics of bond returns and dangers, and fundamental credit analysis techniques are also covered.

Derivatives: This section aids in the development of a conceptual framework for comprehending the fundamentals of derivatives and derivative markets.

Then, the fundamental characteristics and valuation ideas for commitments like forwards, futures, swaps, and contingent claims are introduced.

Finally, it looks at arbitrage, a crucial concept that connects derivative pricing to the underlying asset’s price.

Alternative Investments: Private equity, hedge funds, real estate, commodities, and infrastructure, are discussed in this topic.

It covers using alternative investments to diversify your portfolio and increase your profits.

The course defines alternative investments and the qualities they share in this topic.

Portfolio Management and Wealth Planning: Principles of portfolio and risk management, including return and risk measurement, portfolio planning, and building, are covered in this topic.

It also looks at the needs of individual and institutional investors and the many investment options accessible.

The capital asset pricing model is used to determine the best risk level for a portfolio.

CFA Level II Exam Dates, Cost, and Registration Fees

The CFA exam, including level 2, is conducted throughout a set period, and the exam dates accessible to each candidate may vary depending on appointment availability at the time of scheduling.

It’s important to note that exam registration is a two-step process. You must first register for your exam, after which you must schedule your exam.

If your selected site is not shown, you may need to check back.

To register for the Level 2 of the CFA exam, candidates pay $700 for early registration and $1,000 for standard registration.

Preparing for Level II of the CFA Exam – Prerequisites

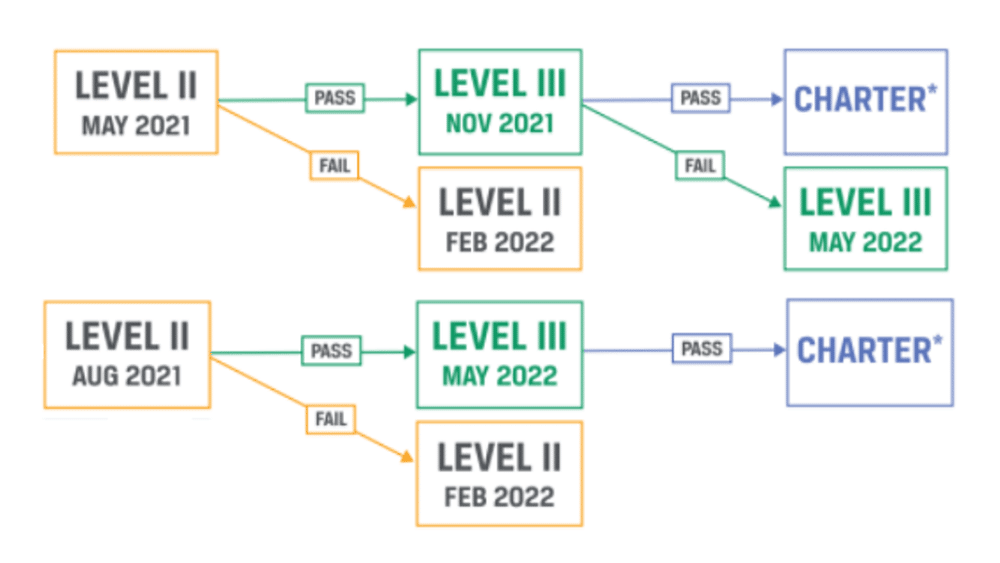

A candidate must pass the CFA level 1 exam to qualify for the CFA Level 2 exam.

After registering for the exam on the CFA website, you must schedule your exam date and test center using the Prometric scheduling tool.

Once you successfully schedule your exam, Prometric will send you a confirmation email.

Long-term preparation before the scheduled exam date is essential to passing the exam.

Using review programs, online or in-person classes, and taking hundreds of mock exams or test questions are invaluable to success in the exam.

CFA Institute will send you a series of emails with basic test information and information on the resources we will make accessible to you and how to use them.

In addition, CFA Institute will provide reminders concerning practice examinations, general exam policies, and other issues as the exam approaches.

CFA Level II Scheduling and Deferrals

During the scheduling process, you will locate Prometric test centers by address, city, or zip code.

Schedule your exam appointment as early as possible to ensure that you get your preferred test center.

On a first-come, first-served basis, only are seats available.

Don’t restrict your search to just a few days.

Choose the complete exam window as the date range. When choosing which day to test, you may need to be flexible.

CFA Level II Prep Courses

CFA Exam prep courses are valuable tools to increase your chances of passing the CFA level 2 exam.

It would be best to do a thorough finding on which prep course provider you want to sign up with.

Examine the instructors’ qualifications and see if they are experts in their teaching subjects.

Confirm that the prep course is based on the most recent curriculum and that the prep provider plans to cover topics that will appear on the exam.

Also, ensure that the vendors’ practice exams and other goods align with the question formats.

It’s crucial to know if a provider’s statements are factual.

Also, be sure that your provider’s course is scheduled in a way that will prepare you for your next exam.

Candidates can take advantage of extra exam prep courses and materials in addition to the study support given by the Chartered Financial Analyst Institute.

In their offerings and communications with CFA Program candidates, approved prep providers agree to follow CFA Institute guidelines and standards.

The recognized providers of the CFA Institute have tools to assist candidates in studying for each exam level.

The CFA Institute’s Approved Preparation Provider (APP) Program guarantees that all providers follow the current CFA Institute curriculum and best practices.

Some approved prep course providers are CFA Society Los Angeles, Kaplan Schweser (DF Institute, LLC), CFA Society New York, Wiley Efficient Learning, and more.

You can find the list of approved CFA exam prep providers on the CFA Institute’s website.

Conclusion

Like any other professional examination, the Chartered Financial Analyst Level 2 exam requires a lot of hard work.

Maximizing the use of exam resources, practice tests, dedicating hundreds of hours to deep study, and ultimately having a robust study plan will ensure a pass even on the first try.

Therefore, it is imperative for any candidate, having passed the level 1 exam, to improve the study arrangements for the next exam level.

FAQs

References

CFA 2 Exam costs, fees, registration