Welcome to another educational article on Chartered Financial Analyst examination pass rates!

This article will give you insights into the CFA exam pass rates, the historical pass rate statistics, what determines the pass rates, and the future impacts.

In this article, we shall look at:

So, let’s continue!

CFA exam pass rate evaluation

Most test-takers evaluate CFA pass rates when deciding whether or not to take the tests.

It lacks respect if the pass rates are too high. Conversely, it is too complex and may not be worth the effort if it is too low.

The pandemic, which occurred at about the launch of computer-based tests and an expanded testing schedule, appears to have drastically altered pass rate patterns for all three levels of the CFA exam.

However, promising early indicators show that this trend returns to the average.

CFA exam pass rates historical statistics

The current November CFA exam results contrast with record low pass rates on the CFA exam at all levels earlier in 2021.

The disruption caused by the epidemic, according to the institute, is one of the reasons behind the trend.

The following are the most recent CFA pass rates:

Level 1 Exam ( November 2021) – 27%

Level 2 Exam( November 2021) – 46%

Level 3 Exam ( November 2021) – 43%

As one might imagine, the average pass rate rises through the three levels.

For example, since 2010, the pass rates for the following CFA exams have been:

- Level 1 covers 22 percent to 49 percent, with a 39 percent average over 11 years

- Level 2 covers 29 percent to 55 percent, with a 44 percent average over 11 years

- Level 3 covers 39 percent to 56 percent, with a 50 percent average over 11 years

One million one hundred six thousand nine hundred sixty-four people between 2012 and 2021 took the Level 1 exam.

In addition, 507,692 people took the Level 2 test, and 291,168 people took the Level 3 exam within the same period.

As a result, we may estimate that around 25% of candidates who begin the procedure will complete all three exams.

Furthermore, we can estimate that around 13.5 percent of all candidates who take the first exam pass all three because 152,213 persons passed the third exam during that period.

We notice a downward trend in all three CFA levels when we look at pass rates over a more extended period (since 1963).

At the same time, as applicants go to Levels 2 and 3, the pass rates rise.

Surprisingly, pass rates have only begun to normalize in the last 15 years or so.

CFA exam level 1 pass rates

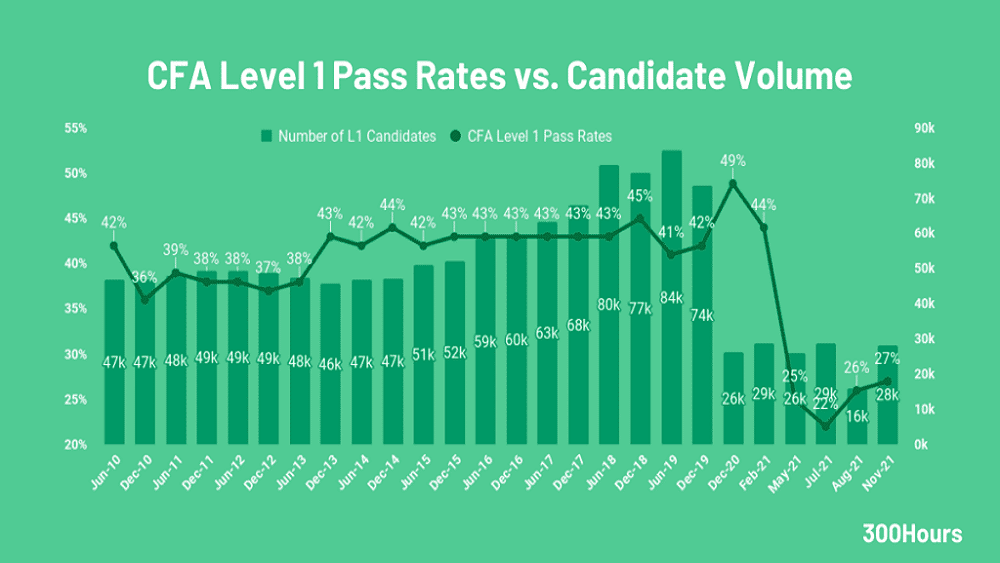

CFA Level 1 has a 10-year weighted average pass rate of 41 percent.

It’s not easy to pass, but the growing trend is encouraging.

Furthermore, the December 2020 pass rate of 49 percent was a bit of an aberration.

Last year, far fewer candidates took the test (26,212 in 2020 versus 157,344 in 2019), but those did exceptionally well.

However, whether this increasing trend will continue through 2021 and beyond remains to be seen.

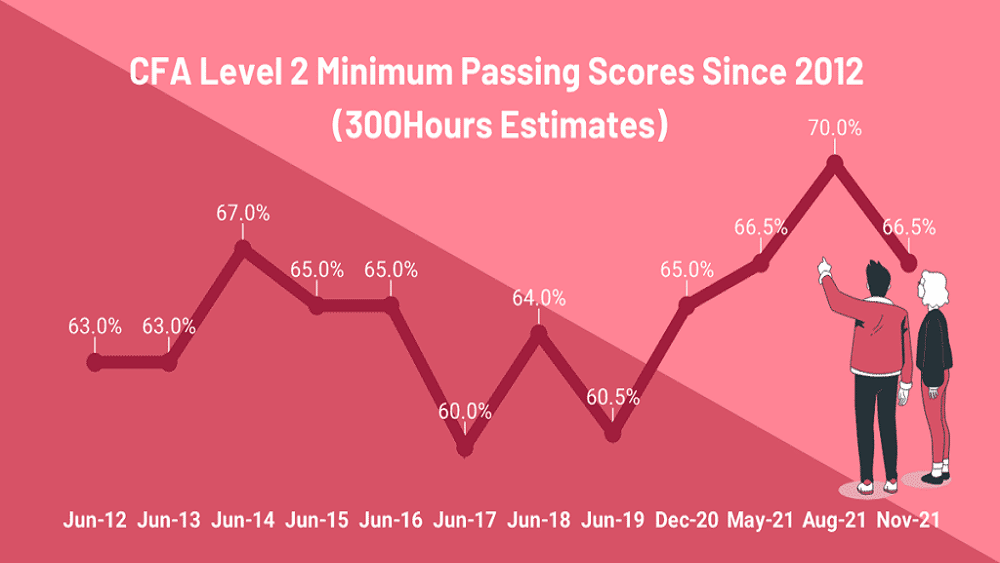

CFA exam level 2 pass rates

CFA level 2 passing rate is 45 percent on a 10-year weighted average, which is somewhat higher than the level 1 passing rate.

The passing rate of CFA candidates increased dramatically once again with the 2020 results.

The Covid-19 pandemic may have given students extra time to study for the exam, but there could also be other variables at play.

In 2020, there were fewer candidates than in prior years who took the Level 2 and 3 tests.

CFA exam level 3 pass rates

Level 3 has the most remarkable 10-year weighted average pass rate of 52 percent.

In contrast to the other two levels, this percentage in 2020 stayed stable during the previous few years.

CFA Pass Rates: How Hard Are The Exams?

The low entry hurdle (usually a bachelor’s degree) attracts many casual exam takers who want to try it out (maybe the first time) without adequately studying for the exam.

These folks never pass the CFA first Level; thus, you won’t see them advance to CFA Level 2 or Level 3, and even fewer will make it to Level 3.

Professionals working in fund management and sell-side equity research used to take the CFA exam.

Nowadays, many applicants come from professions that are connected but not identical, such as accounting and investment banking, and unrelated fields, such as IT, legal, and support personnel.

Although these individuals are intelligent and capable, their lack of prior education and work experience in the investing industry certainly reduces their chances of passing.

One widely-held belief among prospective CFAs is that the exam is getting more complex.

Although it is difficult to quantify, it is safe to assume that the investment product has grown in complexity and sophistication during the last ten years.

Thus, it may be safe to say that the CFA exam is evolving.

CFA exam pass rate: Future Trends

Though the CFA Level 1 exam had its all-time low pass rate of 22% in July 2021 with an average weighted pass rate of 41% between 2012 and 2021, it’s unclear whether the current trend of pass rates settling around 43% may continue in the future.

The level I pass rate of 49% in December 2020 turned out to be slightly higher.

The pass percentage for the level 1 CFA exam fell to 44% in February 2021.

Level 1 pass rates are even lower in May, July, August, and November.

However, we all expect the 2022 level 1 CFA exam pass rates to increase soon.

Conclusion

Candidates can increase their chances of passing the CFA examinations by studying for over 300 hours, using alternate prep resources, answering as many practice questions as possible, and adopting a systematic study plan.

To pass the CFA tests, you don’t need to be an expert on every subject.

The most recent topic weights for each level and their Learning Outcome Statements are freely available on the CFA’s website (LOS).

For example, the Level I exam has the fewest questions on “Technical Analysis,” “Derivatives,” and “Portfolio Management and Wealth Planning,” so you could be better off focusing on a topic like “Ethical and Professional Standards,” which appears more frequently.

In addition, a solid prep course ensures that you don’t have to tackle it alone, keeps you updated on crucial exam topics, and helps you manage your time more effectively.

Finally, remember to keep track of your progress—all of this information may come to you slowly at first.

However, keeping track of your progress, whether in Excel, an app, or old-fashioned pen and paper, will let you recognize how far you’ve come and how far you still have to go.