Hello, welcome to yet another interesting piece on Certified Financial Analysts.

In this article, you will learn about the CFA exam, tips for sitting for and passing the exam, exam fees, and more.

The article outlines the following:

Why take the CFA exam?

While you don’t need to have an advanced degree to be a successful investor, becoming a CFA charter holder gives you access to an elite community of investment professionals.

It opens up financial advisor job opportunities at prestigious firms and gives you a competitive edge over other investors.

Citigroup, BlackRock, JP Morgan Chase, UBS, RBC, Bank of America ML, HSBC, Wells Fargo, Morgan Stanley, Credit Suisse, and State Street are among the most notable corporations with more than 154,000 charterholders.

The CFA program curriculum is based on real-world investing practice and is updated every year to reflect the changing knowledge, skills, and competencies required in today’s industry.

The three-level self-study program cover:

- Equity Investments

- Fixed Income

- Ethical and Professional Standards

- Quantitative Methods

- Economics

- Financial Reporting and Analysis

- Corporate Finance

- Derivatives

- Alternative Investments

- Portfolio Management and Wealth Planning

Gain analytical abilities and competence in quantitative methodologies, economics, financial reporting, investment analysis, and portfolio management by earning your CFA charter.

The CFA exam Format and Structure

Each section of The CFA exam has multiple modules from which to choose.

Each module focuses on a different financial analysis or investment management aspect – many with pre-recorded webinars or video tutorials.

Others give you actionable itemized readings so that as you review each topic area, there is something directly applicable for immediate use.

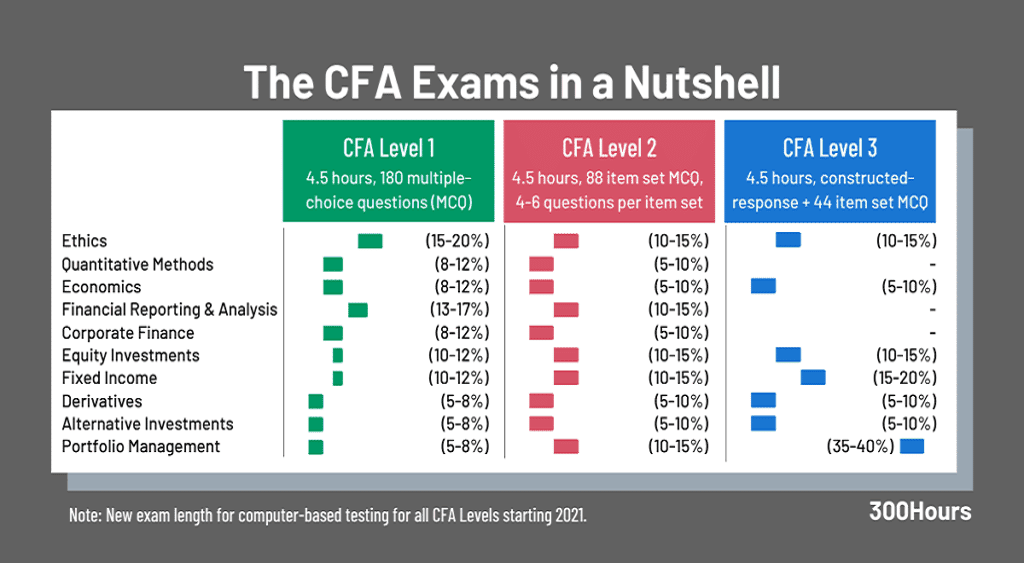

The Level I test comprises two 135-minute sessions with 180 multiple-choice questions (session times are approximate).

Between sessions, there is an optional break.

To receive an exam result, candidates must attend both sessions.

The first session has ninety multiple-choice questions covering ethics and professional standards, mathematical methodologies, economics, and financial reporting and analysis (2 hours, 15 minutes).

90 multiple-choice questions covering corporate finance, equity, fixed income, derivatives, alternative investments, and portfolio management in the second session of 2 hours, 15 minutes duration.

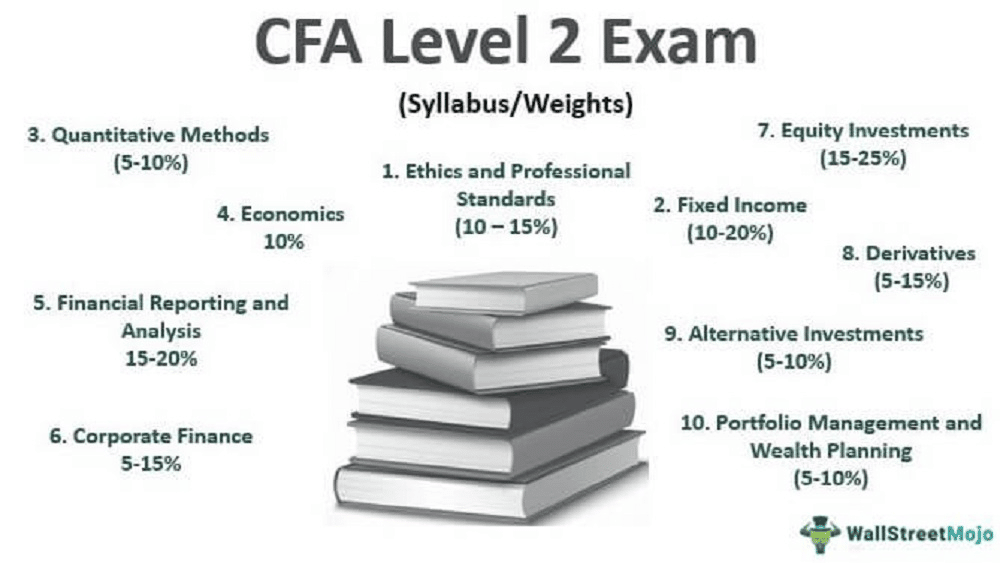

The CFA Level II exam comprises item sets that include vignettes followed by four or six multiple-choice questions. Each of the two sessions will have 44 multiple-choice questions, for a total of 88 questions on the exam, each worth three points.

You will need to use the information in the vignette to answer multiple-choice questions in each item set.

As a result, unlike the CFA Level I exam, the items are not free-standing.

Therefore, before answering each question, you’ll need to refer back to the vignette.

The Level III exam lasts 4 hours and 24 minutes, divided into two 2 hours and 12 minute periods with a break in between.

The CFA Level III exam’s first session consists of 8 to 11 vignettes followed by a series of questions that demand a written response.

This session will also include some multiple-choice questions. For example, you might be offered a multiple-choice question to choose the portfolio (A, B, or C) that best satisfies a specific goal, followed by an essay question to support your choice.

There may also be some numerical entry questions that demand only a number and do not allow you to exhibit your work.

However, standard essay questions will make up the majority of the questions.

The point values of the questions in the essay session vary.

Consider 1 point to be 1 minute spent on the essay vignette for time management purposes.

The CFA Exam Time Frame

Exam scores for the CFA Program do not expire, and you are not needed to re-enroll each year.

You can complete the CFA Program at any given time.

Every applicant who does not pass their exam will have to wait at least six months to repeat it, starting from 2021.

For example, if a Level I candidate fails the February 2021 administration, they won’t retake the exam until August 2021.

Alternatively, a Level II candidate who takes the exam in August will not be eligible to take the Level III exam until May 2022.

How much does the CFA Exam cost?

The standard exam registration period for August 2022 CFA exams runs from February 10, 2022, through May 3, 2022, and is open to Level I, Level II, and Level III candidates.

While the Level I and Level II early registration period runs from October 26, 2021, through February 9, 2022.

Level III early-enrollment began on December 1, 2021.

Early Registration Fee | Standard Registration Fee | |

Enrollment Fee | $450 | $450 |

Level 1 | $700 | $1,000 |

Level 2 | $700 | $1,000 |

Level 3 | $700 | $1,000 |

Total CFA program fees | $2,550 | $3,450 |

Understanding what it takes to pass the CFA EXam

The CFA Institute Board of Governors approves each level’s minimum passing score (MPS) after each exam administration.

The purpose is to ensure that applicants are treated equally throughout administrations, as the difficulty of each test is considered when determining the MPS.

The MPS or individual candidate scores are not made public by the CFA Institute.

To pass the CFA exam, you must obtain at least the minimum passing score (MPS) established by the CFA Institute Board of Governors following each exam.

The all-time average pass rate for CFA Level I is barely 42%, and pass rates in 2021 have been even lower.

Resources for preparing for the CFA exams

If you’re thinking about taking the CFA exam, you should think about taking some classes to guarantee you’re as prepared as possible.

With so many options in the test-prep world, it’s essential to think about your learning style, budget, and time limits.

It’s also worth noting that these are all subject to change as you progress through the examinations.

One approach is to study directly from the free materials provided by the CFA Institute.

Five study resources can help you prepare well for the CFA exam. These are:

- Self-study materials, books(printed or electronic)

- Mock exam questions (printed or online)

- Class Instruction (live session or online)

- Review courses

- Tutoring (instructor access by email)

You can use exam preparation courses to supplement or replace your self-study from the CFA Institute’s resources.

CFA exam prep courses are a vital resource for passing the CFA exam.

You may choose a CFA prep course that fits your learning style. some of the best prep courses available include:

- Wiley CFA Review Course

- The Princeton Review CFA

- Bloomberg CFA Exam Prep

- Fitch Learning

- Kaplan Schweser

After the exam, what Next?

CFA charterholders work in various investment decision-making jobs, the most common of which are research analysts and portfolio managers.

Research analysts advise investors in both public and private companies, while some portfolio managers are responsible for managing client portfolios that can contain hundreds of securities.

If you pass the CFA exams, the sky limits how much you can achieve in the finance and investment industry.

The CFA designation offers doors to prestigious firms such as hedge funds, mutual funds, commercial banks, and other financial institutions.

What’s more, since it’s an asset management designation recognized throughout the world, having your CFA on your resume will make it easier to work around the world if you choose.

For most people taking the exam, getting that first job is just one step along a path toward careers with greater responsibility.

Many who study for and pass financial certification exams continue their studies at business schools like Booth or Northwestern University Kellogg School of Management.

Many of the world’s most prestigious financial firms hire CFA charterholders because they are considered the industry’s “gold standard.”

The Chartered Financial Analyst charter certifies that you have mastered a wide range of portfolio management and advanced investment analysis skills.

Conclusion

The Certified Financial Analyst Exam is not easy.

However, if you genuinely want to become a financial analyst, it’s worth it, and there are lots of resources and study materials out there to help you succeed.

Keep studying and preparing for months or even years before your first attempt.

The CFA exam requires perseverance to pass on the first try, so don’t get discouraged too quickly.

FAQs

References

About the CFA Program – Dates & Costs